Payroll services to help you simplify and transform your business.

We get it.

And we can help.

Payroll Services and Benefits

We provide payroll services that are marked by the same excellence and attention to detail that customers love about all their services.

Our payroll services include:

Paying employees via check or direct deposit.

Processing payroll tax deposits.

Paid time-off (PTO) tracking.

Filing state and federal payroll tax forms including Forms 941 & W2.

Time tracking automation for hourly employees.

Employee benefit setup and tracking.

Why you should choose us to manage your payroll?

Less work for you

When we manage your payroll, we handle everything. You do not have to setup your new employees in an online system or even remember to login and submit your payroll each week.

With us, all you have to do is send them your employee’s pay information (i.e. hours, salary, or commission amounts) and they handle the rest.

Additionally, if we provide your bookkeeping, we will enter your payroll data into your accounting file for no additional charge.

Better customer service

We provide a personal touch that larger providers just can’t provide.

When you call us, you promptly get a live support agent who generally is the same person processing your payroll.

Everything in one place

When we manage both your accounting and payroll, you enjoy a one-stop-shop experience that is hard to beat.

This results in time savings and less headache dealing with multiple sources.

More flexibility

Only have one employee or an inconsistent pay cycle?

Need more flexibility for those one-offs or last minute changes?

No problem.

Because we are specialized in and dedicated to small businesses and organizations, we are able to provide “out of the box” solutions that many larger firms can’t provide.

Our payroll services are cost-effective, giving you back the time you need to run your company and focus in improving your products and services.

We keep up with the changing federal and state tax laws so that you don’t have to.

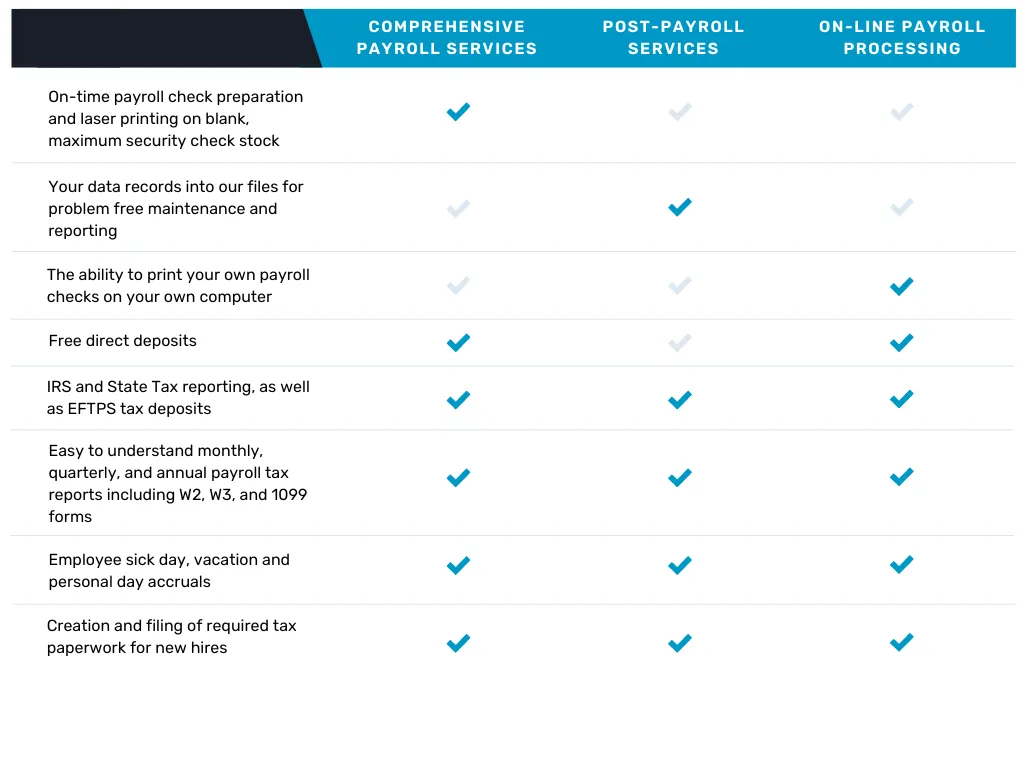

And because we understand that the needs for every business vary, we offer you three different levels of payroll services.

Comprehensive Payroll Services

This is your full-service, no hassle payroll plan where we provide the following…

On-time payroll check preparation and laser printing on blank, maximum security check stock

Free direct deposits

IRS and State Tax reporting, as well as EFTPS tax deposits

Easy to understand monthly, quarterly, and annual payroll tax reports including W2, W3, and 1099 forms

Employee sick day, vacation and personal day accruals

Creation and filing of required tax paperwork for new hires

Post-Payroll Services

If you prefer to manually process your payroll checks, we can help by providing the following services…

Your data records into our files for problem free maintenance and reporting

IRS and State Tax reporting, as well as EFTPS tax deposits

Easy to understand monthly, quarterly, and annual payroll tax reports including W2, W3, and 1099 forms

Employee sick day, vacation and personal day accruals

Creation and filing of required tax paperwork for new hires

On-Line Payroll Processing

Enter employee hours and earning online and you will get…

The ability to print your own payroll checks on your own computer

Free direct deposits

IRS and State Tax reporting, as well as EFTPS tax deposits

Easy to understand monthly, quarterly, and annual payroll tax reports including W2, W3, and 1099 forms

Employee sick day, vacation and personal day accruals

Creation and filing of required tax paperwork for new hires

Other Payroll Services

We can also help you with the following…

Worker’s Compensation Audits

Unemployment Claims

Social Security Audits

Child Support Audits

W-2 and W-3 processing

1099 and 1096 processing

Preparation/assistance with Federal and State registration forms

Comprehensive Payroll Services

This is your full-service, no hassle payroll plan where we provide the following…

On-time payroll check preparation and laser printing on blank, maximum security check stock

Free direct deposits

IRS and State Tax reporting, as well as EFTPS tax deposits

Easy to understand monthly, quarterly, and annual payroll tax reports including W2, W3, and 1099 forms

Employee sick day, vacation and personal day accruals

Creation and filing of required tax paperwork for new hires

Post-Payroll Services

If you prefer to manually process your payroll checks, we can help by providing the following services…

Your data records into our files for problem free maintenance and reporting

IRS and State Tax reporting, as well as EFTPS tax deposits

Easy to understand monthly, quarterly, and annual payroll tax reports including W2, W3, and 1099 forms

Employee sick day, vacation and personal day accruals

Creation and filing of required tax paperwork for new hires

On-Line Payroll Processing

Enter employee hours and earning online and you will get…

The ability to print your own payroll checks on your own computer

Free direct deposits

IRS and State Tax reporting, as well as EFTPS tax deposits

Easy to understand monthly, quarterly, and annual payroll tax reports including W2, W3, and 1099 forms

Employee sick day, vacation and personal day accruals

Creation and filing of required tax paperwork for new hires

Other Payroll Services

We can also help you with the following…

Worker’s Compensation Audits

Unemployment Claims

Social Security Audits

Child Support Audits

W-2 and W-3 processing

1099 and 1096 processing

Preparation/assistance with Federal and State registration forms

Contact us for a FREE consultation and to get payroll processing estimates for your business.

Testimonials

As a new business owner we had no idea what we were doing. Merritt Innovative Consulting & Advisory walked us through the whole process and supported us every step of the way. So glad we used them!

Keira Webb

Aubrey is super knowledgeable and easy to work with. I ask a lot of questions and the service is always timely and accurate. 10 out of 10 recommend for all my tax and accounting needs.

Chris Renteria

Let us help you transform your business and simplify your accounting.

You can't go wrong with us.

Book a call with us today.

Copyright © 2025 Merritt Innovative Consulting & Advisory, LLC, All Right's Reserved.